ruvip.ru

Learn

Credit Cards For Decent Credit

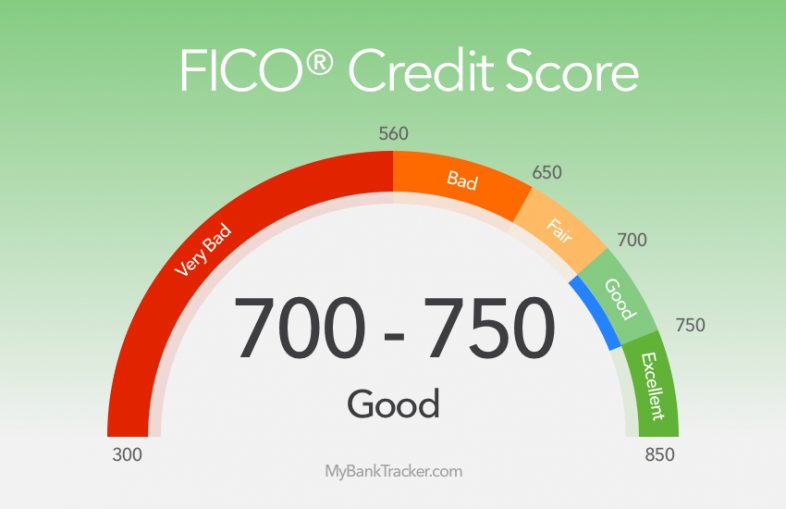

Credit Cards for Fair Credit Score · Credit One Bank® Platinum Visa® · Revenued Business Card · OpenSky® Plus Secured Visa® Credit Card · Revvi Visa® Credit Card. A closer look at the best credit cards for those with fair credit score · Capital One QuicksilverOne Cash Rewards Credit Card · Discover it Student Cash Back. 18 partner offers · Reflex Platinum Mastercard · Platinum Prestige Mastercard Secured Credit Card · AvantCard · Credit One Bank American Express Credit Card. The average credit card interest rate in America today is % — tied for the highest since LendingTree began tracking rates monthly in From my experience, having a couple of cards that you manage well is usually enough to build and maintain a good credit score. Since you're. The following cards are designed for individuals with credit scores in the , , , , or ranges. FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR FAIR OR AVERAGE CREDIT · Capital One QuicksilverOne Cash Rewards Credit Card · Upgrade Cash Rewards Visa®. Apply online for a Canadian credit card today. RBC Royal Bank offers a variety of cash back, rewards, low interest, business, travel credit cards and more. Why this is one of the best cards for good credit: The Capital One SavorOne Cash Rewards Credit Card requires a credit score of or higher to qualify. Credit Cards for Fair Credit Score · Credit One Bank® Platinum Visa® · Revenued Business Card · OpenSky® Plus Secured Visa® Credit Card · Revvi Visa® Credit Card. A closer look at the best credit cards for those with fair credit score · Capital One QuicksilverOne Cash Rewards Credit Card · Discover it Student Cash Back. 18 partner offers · Reflex Platinum Mastercard · Platinum Prestige Mastercard Secured Credit Card · AvantCard · Credit One Bank American Express Credit Card. The average credit card interest rate in America today is % — tied for the highest since LendingTree began tracking rates monthly in From my experience, having a couple of cards that you manage well is usually enough to build and maintain a good credit score. Since you're. The following cards are designed for individuals with credit scores in the , , , , or ranges. FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR FAIR OR AVERAGE CREDIT · Capital One QuicksilverOne Cash Rewards Credit Card · Upgrade Cash Rewards Visa®. Apply online for a Canadian credit card today. RBC Royal Bank offers a variety of cash back, rewards, low interest, business, travel credit cards and more. Why this is one of the best cards for good credit: The Capital One SavorOne Cash Rewards Credit Card requires a credit score of or higher to qualify.

Capital One credit cards for fair credit include QuicksilverOne, Quicksilver Secured, and the Platinum Mastercard. Your credit score is only one of the many. Read our top card reviews · Wells Fargo Active Cash® Card · Citi Custom Cash® Card · Chase Freedom Unlimited® · Capital One SavorOne Cash Rewards Credit Card · Citi®. Many of the best rewards credit cards are available to those who have good to excellent credit—a FICO Score of to plus—to qualify for an account. What makes a good first credit card? · Low or no annual fees. Check the annual fees on credit cards. · Credit builder features. · Monthly reporting to all three. Easily compare and apply online for Good credit score credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Purchases with Cy-Fair FCU's Global Good Credit Card not only earn you rewards, but also directly benefit the Worldwide Credit Union Foundation's efforts to. If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. This. good standing. Why should you choose a no annual fee credit card? There are several reasons why you might prefer a TD no annual fee credit card in Canada. Capital One Venture Rewards Credit Card. Capital One Venture Rewards Credit Card · On Capital One's Website · Earn 75, bonus miles ; Chase Sapphire Preferred®. There are credit cards available for people who are just starting out with credit, those who have made some credit missteps, and those with average credit. Capital One Quicksilver Cash Rewards for Good Credit · Earn unlimited % cash back on every purchase, every day · $0 annual fee and no foreign transaction. Credit Cards for Fair Credit Score · Credit One Bank® Platinum Visa® · Revenued Business Card · OpenSky® Plus Secured Visa® Credit Card · Revvi Visa® Credit Card. Credit Cards for Good Credit · Capital One Quicksilver Cash Rewards for Good Credit · Synchrony Premier World Mastercard® · Capital One SavorOne Cash Rewards. These cards accommodate a mix of financial goals, from cash-back rewards to balance transfers, but all offer top-of-class benefits. Find the credit cards for your good credit score with Credit Sesame. Compare offers from our partners and make sure you get the features that matter most to. Best credit cards for fair/average credit in September · + Show Summary · Capital One Platinum Credit Card · Discover it® Student Cash Back. We want to help you discover credit card options that might be available to you. Browse Categories. Review featured cards from our partners below. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. Some of the benefits of a standard credit card include convenience, security, the ability to extend payments over time, low interest on balance transfers, cash. The Avant Credit Card may help strengthen your credit with responsible use. Avant reports to all three major credit bureaus.

What Is The Best Low Interest Credit Card

Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. Earn up to 5% cash back on two categories you choose. U.S. BANK ALTITUDE ® GO. Earn 20, bonus points worth $ U.S. BANK VISA ® PLATINUM. Get a low. CIBC bizline® Visa* Card about the CIBC bizline Visa Card. Interest as low as CIBC Prime plus %. Grow your business with affordable credit and low interest. best served by rewards-based credit cards. This holds true, for the most lower interest rate card is the better choice. Annual rewards would only. Some cards give you an opportunity to earn a cash bonus after you spend a certain amount of money over a specific period. Open a low-interest, 0% APR, or. The best low APR secured credit card is the Amazon Secured Credit Card because its regular APR of 10% is among the lowest rates available to people with bad. Scotiabank Value® Visa* Card. 0% introductory interest rate on balance transfers for the first 10 months (% after that; annual fee $29).2 Plus no. 8 best 0% APR and low-interest credit cards of September ; Capital One VentureOne Rewards Credit Card · Capital One VentureOne Rewards Credit Card ; Blue. The BMO Preferred Rate Mastercard gives you our biggest savings with a low annual fee and a lower interest rate than other BMO credit cards at %. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. Earn up to 5% cash back on two categories you choose. U.S. BANK ALTITUDE ® GO. Earn 20, bonus points worth $ U.S. BANK VISA ® PLATINUM. Get a low. CIBC bizline® Visa* Card about the CIBC bizline Visa Card. Interest as low as CIBC Prime plus %. Grow your business with affordable credit and low interest. best served by rewards-based credit cards. This holds true, for the most lower interest rate card is the better choice. Annual rewards would only. Some cards give you an opportunity to earn a cash bonus after you spend a certain amount of money over a specific period. Open a low-interest, 0% APR, or. The best low APR secured credit card is the Amazon Secured Credit Card because its regular APR of 10% is among the lowest rates available to people with bad. Scotiabank Value® Visa* Card. 0% introductory interest rate on balance transfers for the first 10 months (% after that; annual fee $29).2 Plus no. 8 best 0% APR and low-interest credit cards of September ; Capital One VentureOne Rewards Credit Card · Capital One VentureOne Rewards Credit Card ; Blue. The BMO Preferred Rate Mastercard gives you our biggest savings with a low annual fee and a lower interest rate than other BMO credit cards at %.

Our lower APR Voice Credit Card offers a lower interest rate instead of rewards. That means you can pay less with Voice. Choose the best low interest rate credit cards for you. TD Visa Low interest A low interest rate credit card has a rate of interest that is usually. RBC RateAdvantage Visa · Annual Fee: $0 · Purchase Rate: Prime + % - % · Additional Card: $0 · Cash Advance Rate: Prime + % - %. interest debt from one or more credit cards onto a credit card with a lower interest. icon. Ongoing interest rates. Also often referred to as “regular APR. Find the best RBC low interest credit card for you and save money on your balance. Choose from no or low fee, fixed or variable rate cards. Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits. If you tend to carry a credit card balance, it's important to have the lowest interest rate possible. With the Low Rate credit card from Mountain America, you. APR for Cash Advances. Visa Signature Rewards %. Visa Platinum Rewards % to %, based on creditworthiness. Visa Platinum Best Rate % to %. Reduce interest payments with a low interest rate credit card. Annual fee $ Purchase interest rate 1 %. Cash interest rate 1 %. Highlights - Capital One VentureOne Rewards Credit Card · Click APPLY NOW to apply online · $0 annual fee and no foreign transaction fees · Earn a bonus of 20, BECU Visa Credit Card. The BECU Visa Credit Card has two things going for it — a 0% intro APR for 12 months on purchases and a low APR of % to %. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro APR for 15 months; % - % variable. Then % - % Standard Variable Purchase APR applies. Offers vary based on card type. See below for more information on rates, fees, and other important. A low rate card will be worth considering if you want to fix a lower interest rate on your borrowing, so you know that you'll be able to afford your repayments. Low-Interest Personal Loans Best Personal Loans For Fair Credit Best Joint Personal Loans How To Lower Your Credit Card Interest Rate · How To Apply For. The average APR in the United States is % this also includes business cards, higher interest store cards & student cards. Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card reviews. Rated out of 5 . That's why we've designed a credit card that rewards you every step of the way. Our Visa Classic Credit Card is perfect for those looking for a standard credit. What credit cards have low interest rates? · Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union · Citi Simplicity® Card. Our low-interest Smart Option credit card puts you in charge. Consolidate your credit with lower interest, no annual fee and added protection wherever you make.

How Do I Get Into The Music Industry

I've written this guide on how to break into the music industry but not as a musician. It's perfect for music-loving, tone-deaf candidates everywhere. We will explore how to develop your unique sound, create quality music, build a compelling online presence, and effectively network and collaborate with others. Networking and Building Connections. Networking is how to enter the music industry and hit the ground running. Building connections with industry professionals. To break into the music industry, you will need to utilize the right tools. Leveraging your LinkedIn page, working at venues, studio time, connecting with. We will explore how to develop your unique sound, create quality music, build a compelling online presence, and effectively network and collaborate with others. Job Profiles ; Do you play an instrument or sing? Artist · Session Musician ; Do you like writing and creating songs or music? Songwriter · Composer for Video. Breaking into the music industry can be challenging, but this comprehensive guide will show you how to get started. Breaking into the music industry requires passion, hard work, and dedication to land where you want to end up. Seven top tips on breaking into the music industry: 1. Get work experience. These professionals say getting work experience is a great way in. I've written this guide on how to break into the music industry but not as a musician. It's perfect for music-loving, tone-deaf candidates everywhere. We will explore how to develop your unique sound, create quality music, build a compelling online presence, and effectively network and collaborate with others. Networking and Building Connections. Networking is how to enter the music industry and hit the ground running. Building connections with industry professionals. To break into the music industry, you will need to utilize the right tools. Leveraging your LinkedIn page, working at venues, studio time, connecting with. We will explore how to develop your unique sound, create quality music, build a compelling online presence, and effectively network and collaborate with others. Job Profiles ; Do you play an instrument or sing? Artist · Session Musician ; Do you like writing and creating songs or music? Songwriter · Composer for Video. Breaking into the music industry can be challenging, but this comprehensive guide will show you how to get started. Breaking into the music industry requires passion, hard work, and dedication to land where you want to end up. Seven top tips on breaking into the music industry: 1. Get work experience. These professionals say getting work experience is a great way in.

A contract meant that the record label bankrolled a professional studio recording and allowed the artist entry into the record labels' international. The music industry refers to the individuals and organizations that earn money by writing songs and musical compositions, creating and selling recorded. By now all rock bands are wise enough to be suspicious of music industry scum. This means more than plugging a guitar into a tuner. How should the. Advertising, connecting with professionals, and marketing yourself are the best ways to network in the music industry. Collaborate with professional Recording. Think Critically, Do Homework · Setting up your business entity · Starting your publishing company or getting your music licensed · Getting your music into. The size of the envelope tells me what is inside (whether it is a thrown together CD with a Polaroid photo or a proper press kit with 8x10 photo etc). The. From record label executives to music managers, publicists, agents, and concert technicians, people in these music industry careers work together to bring. Music Creation. Freelance Composer, Composer's assistant, Sound design for video games, podcasts, etc. · Music Marketing. Social Media Coordinator, Merch. This book shows you how to get into the music industry and have a sustainable career. Whether it's by practicing endless hours, or by knowing every single new. From record label executives to music managers, publicists, agents, and concert technicians, people in these music industry careers work together to bring. Choose your career path (artist, music producer, audio engineer, etc.) Shadow a music industry pro; Build lots of connections in the music industry. You're. Here are 5 top music career mistakes that destroy your chances to build a successful music career and make it big in the music industry. So look into volunteering at music festivals, get a part-time job in a record shop or start your own music blog reviewing local gigs. Do your research to find. Working at a radio station can be a pretty exciting job. You can hear new music as it comes in and even push it into rotation to give artists a leg up. People. The qualifications that you need to get a music industry job with no experience include musical skills, technical knowledge, or a relevant degree. Having talent is the first step towards getting noticed in the music industry. Being able to sing or play your instrument well is one of the main parts of. The music industry refers to the individuals and organizations that earn money by writing songs and musical compositions, creating and selling recorded. Delivered in a condensed format of three consecutive week terms over 12 months · Study inside a studio environment using industry standard equipment · Book. Tip #1 For How To Make It In Music: Practice To Become A Professional Musician. Continuously work on improving your musical skills. Start with reading music industry blogs to stay on top of what's happening in the music industry, and think about what kind of company you'd like to work for.

What Is Accident And Dismemberment Insurance

Accidental Death & Dismemberment (AD&D) is a plan that pays a benefit if you lose your life, limbs, eyes, speech or hearing due to an accident. Full-time. Accidental death and dismemberment insurance differs from life insurance in that it pays out to a beneficiary when the policyholder passes away due to an. What is AD&D insurance? AD&D insurance includes coverage for fatal and nonfatal accidents involving dismemberment or loss of eyesight or hearing. With most. SEIU Accidental Death and Dismemberment (AD&D) Insurance is an important coverage that can help supplement your existing life insurance. Whether an accident resulting in a covered injury or loss of life happens at work or away, this AD&D insurance coverage pays you or your beneficiary a cash. Accidental death and dismemberment insurance, known in the insurance industry as AD&D, typically serves as a supplement to more comprehensive employee. AD&D insurance can help protect families from financial hardship by paying a benefit upon death or serious injury due to a covered accident. Accidental death and dismemberment (AD&D) can help protect employees and their loved ones in the event of an unexpected loss of life or an irrerversible. Accidental death and dismemberment (AD&D) insurance is a voluntary benefit intended to supplement your life insurance coverage. AD&D coverage can help to. Accidental Death & Dismemberment (AD&D) is a plan that pays a benefit if you lose your life, limbs, eyes, speech or hearing due to an accident. Full-time. Accidental death and dismemberment insurance differs from life insurance in that it pays out to a beneficiary when the policyholder passes away due to an. What is AD&D insurance? AD&D insurance includes coverage for fatal and nonfatal accidents involving dismemberment or loss of eyesight or hearing. With most. SEIU Accidental Death and Dismemberment (AD&D) Insurance is an important coverage that can help supplement your existing life insurance. Whether an accident resulting in a covered injury or loss of life happens at work or away, this AD&D insurance coverage pays you or your beneficiary a cash. Accidental death and dismemberment insurance, known in the insurance industry as AD&D, typically serves as a supplement to more comprehensive employee. AD&D insurance can help protect families from financial hardship by paying a benefit upon death or serious injury due to a covered accident. Accidental death and dismemberment (AD&D) can help protect employees and their loved ones in the event of an unexpected loss of life or an irrerversible. Accidental death and dismemberment (AD&D) insurance is a voluntary benefit intended to supplement your life insurance coverage. AD&D coverage can help to.

Accidental Death and Dismemberment Insurance. Accidental Death and Dismemberment Insurance (AD&D) pays benefits of up to twice your annual benefits base salary. The Flexible Benefits Program offers accidental death and dismemberment (AD&D) insurance to be paid to you or your beneficiary if your death or injury is the. Accidental Death and Dismemberment (AD&D) coverage through MetLife provides benefits to your family if you die, or to you if you are dismembered or. Accidental Death and Dismemberment (AD&D) coverage through MetLife provides benefits to your family if you die, or to you if you are dismembered or. Accidental death and dismemberment insurance, or AD&D insurance, is a plan that helps cover the plan holder if an accident causes them to pass away or suffer. A beneficiary is the person who will receive the proceeds of your AD&D insurance should you pass away due to an accidental injury. You can choose anyone as your. Accidental death and dismemberment insurance (AD&D) is also known as personal accident insurance (PAI). An AD&D policy provides a lump-sum payment to you or. Accidental Death and Dismemberment insurance is coverage for a death or permanent physical injury due to a covered accident. AD&D coverage typically defines. Accidental Death and Dismemberment Insurance from Chubb provides a second-to-none enhanced loss schedule along with some of the most comprehensive auxiliary. AD&D insurance provides protection against financial losses due to accidental death or accidental dismemberment. This program is administered by Unum. The. Accidental Death and Dismemberment insurance is coverage for a death or permanent physical injury due to a covered accident. AD&D coverage typically defines. Accidental Death & Dismemberment (AD&D) is a plan that pays a benefit if you lose your life, limbs, eyes, speech or hearing due to an accident. Full-time. Accidental Death and Dismemberment Insurance (AD&D) protects you against losses resulting from a covered accident. NYL GBS Accidental Death and Dismemberment (AD&D) insurance on an employer- or employee-paid basis in your comprehensive benefits strategy helps employees stay. Accidental death insurance provides financial support for your loved ones if you die in a covered accident. It's available for anyone between the ages of Accidental Death and Dismemberment Insurance provides coverage at all times for most accidents that occur on or off the job, at home or away, anywhere in. AD&D insurance coverage protects you and your family against losses that occur in the event of an accident resulting in death or the loss of sight or limb. An accidental death and dismemberment (AD&D) policy provides financial benefits to the insured or their beneficiaries in the event of accidental death. The plan provides benefits if the accident results in: Death or dismemberment or loss of sight, speech, or hearing caused by an accident; Paraplegia. This supplemental insurance can provide financial help in the case of severe injury or accidental death.

How Much Do You Pay For A Foreclosed Home

When a homeowner misses or completely stops making their mortgage payments, the lender can repossess the property and the home goes into foreclosure. To buy a foreclosed home, you can start by finding properties in your area that are being sold at auction or through a real estate agent specializing in. Foreclosed homes typically auction for % below market value with lenders being happy to recoup for 80 to 70 cents on the dollar of the home's appraised. Whether you're a greenhorn or an old hand in the real estate game, buying a foreclosed home can be a savvy move. It's a chance to build equity quicker than. If buying from a bank, you'll need to sharpen your bargaining skills and start with a lowball offer on the property you want. Banks that have accumulated. can be an overwhelming experience if you don't follow the right process. Learn the steps on how to buy a foreclosed home. If you plan to finance a foreclosure purchase, you will want to obtain a preapproval from a mortgage lender. You might also consider specific loan programs. property (as is often the So, when you buy a property in foreclosure, under the Contract of Purchase and Sale, you typically do not get the appliances. Get pre-approved for financing. When purchasing a foreclosed home, the type of financing you need depends on the stage of foreclosure. Foreclosure auctions. When a homeowner misses or completely stops making their mortgage payments, the lender can repossess the property and the home goes into foreclosure. To buy a foreclosed home, you can start by finding properties in your area that are being sold at auction or through a real estate agent specializing in. Foreclosed homes typically auction for % below market value with lenders being happy to recoup for 80 to 70 cents on the dollar of the home's appraised. Whether you're a greenhorn or an old hand in the real estate game, buying a foreclosed home can be a savvy move. It's a chance to build equity quicker than. If buying from a bank, you'll need to sharpen your bargaining skills and start with a lowball offer on the property you want. Banks that have accumulated. can be an overwhelming experience if you don't follow the right process. Learn the steps on how to buy a foreclosed home. If you plan to finance a foreclosure purchase, you will want to obtain a preapproval from a mortgage lender. You might also consider specific loan programs. property (as is often the So, when you buy a property in foreclosure, under the Contract of Purchase and Sale, you typically do not get the appliances. Get pre-approved for financing. When purchasing a foreclosed home, the type of financing you need depends on the stage of foreclosure. Foreclosure auctions.

While you can purchase the property at any point during the foreclosure, you should know from the outset that the process is much different and often times. Once you put in the elbow grease to complete these repairs your home will be worth a lot more than what you purchased it for regardless if local listings have. But we're often told you get what you pay for, which can make foreclosed homes seem scary. Why are those prices so low, anyway? And is the mortgage process any. Then the foreclosed property becomes a real estate owned property of the bank, called a REO property, often shortened to just REOs. During this holding period. How do you buy a foreclosed home? The two common ways of buying a foreclosed home are through a real estate agent or through a public auction. There are many. Typically foreclosed homes are sold at auction and as “as is”, you pay the bid price and the home is yours. The bank eats the unpaid balance. Foreclosure commonly comes about because a homeowner has failed to make mortgage payments, but it can happen for other reasons too, like unpaid property taxes. If you plan to finance a foreclosure purchase, you will want to obtain a preapproval from a mortgage lender. You might also consider specific loan programs. Foreclosed houses often have multiple liens against them. Before you can take ownership of the home, those need to be paid off. Again, when you are buying from. Consult with real estate agents who specialize in foreclosed properties, and consider attending foreclosure auctions. You can also contact a local lender or a. Auctions of these properties require 20% deposits to be paid on the day of the auction with a money order or certified check. If a winning bid is submitted, you. What are the benefits of buying foreclosed or distressed homes? · You may avoid traditional bidding wars. You're less likely to compete with as many other buyers. We would be delighted to discuss the process and whether a foreclosed property is right for you! Please sign up as a VIP member (specify Foreclosures in the. However, quite often there are some misconceptions of what a foreclosure is, and the amount one can save when buying a foreclosed home. Once you navigate some. Top 10 questions to know when you are buying a foreclosure in Minnesota. What is a foreclosure? Can I get a great deal? Can I buy directly from the bank? How Does The Foreclosure Process Work In BC? If you have missed or are late on payments, you do not automatically forfeit your home to a lender. Lenders don. See how much you qualify for · Estimate your monthly payment. Just getting Find a Home You'll Love. Choose Homes by Amenity. New York Waterfront Homes. Homebuyer Assistance is not available if you have already purchased the property. Information About: Purchasing a Foreclosed Property. How do I buy a foreclosed. Foreclosure auctions typically require buyers to pay in cash, but you can finance a pre-foreclosure or bank-owned property using a traditional home loan with. Minnesota is a non-judicial foreclosure state, meaning the foreclosure process does not go through the court system. As a result, lenders do not have to obtain.

Best Place For Rv Financing

Recreational vehicle, camper or motorhome – full-timer or weekender – Alliant can help you with RV financing that fits your lifestyle. Where to Get an RV Loan RV loans are provided by dealerships, banks, and credit unions. Be sure to do your research into all three options, as loan rates and. Get a quote or apply for an RV loan with the Good Sam Finance Center. Get low rates and flexible financing to purchase or refinance a new or used motor home. Lazydays works with the leading RV financing lenders nationwide to deliver flexible loan options so you can shop for a recreational vehicle with confidence. Traditionally, buyers would look to banks or credit unions to secure personal loans, while some might consider applying for an RV loan with a lender who has. When you finance with an RV Lending Specialist, we have the opportunity to search several banks who are competing for the best rate possible for you. Also. We make it easy to finance that motorhome, fifth wheel, toy hauler, camper or travel trailer you've had your eye on. We also offer RV loan refinancing options. Looking for RV financing? Finance your recreational dreams of a motorhome with a LightStream loan. Use our RV loan calculator to see our current rates. When you're ready to buy, your US Bank RV financing pre-approval is good at any of our participating dealerships. Recreational vehicle, camper or motorhome – full-timer or weekender – Alliant can help you with RV financing that fits your lifestyle. Where to Get an RV Loan RV loans are provided by dealerships, banks, and credit unions. Be sure to do your research into all three options, as loan rates and. Get a quote or apply for an RV loan with the Good Sam Finance Center. Get low rates and flexible financing to purchase or refinance a new or used motor home. Lazydays works with the leading RV financing lenders nationwide to deliver flexible loan options so you can shop for a recreational vehicle with confidence. Traditionally, buyers would look to banks or credit unions to secure personal loans, while some might consider applying for an RV loan with a lender who has. When you finance with an RV Lending Specialist, we have the opportunity to search several banks who are competing for the best rate possible for you. Also. We make it easy to finance that motorhome, fifth wheel, toy hauler, camper or travel trailer you've had your eye on. We also offer RV loan refinancing options. Looking for RV financing? Finance your recreational dreams of a motorhome with a LightStream loan. Use our RV loan calculator to see our current rates. When you're ready to buy, your US Bank RV financing pre-approval is good at any of our participating dealerships.

Hit the road with an RV loan from Sandia Area Federal Credit Union! Finance your new or used RV, trailer, camper, or motor home with up to % financing. Medallion Bank offers RV financing for dealerships so you can focus on what you do best, which is selling recreational vehicles. We finance RVs, motorhomes. When you finance with an RV Lending Specialist, we have the opportunity to search several banks who are competing for the best rate possible for you. Also. Credit Unions: Credit unions also offer secure RV loans, which can allow you to finance your RV with a loan, even if you have bad credit. Online Lenders: Online. A closer look at our top RV loan lenders · LightStream: Best overall RV loan · LightStream: Best overall RV loan · Upgrade: Best for flexible fair-credit terms. With Sunwest's experience of over 30 years in business we understand the RV lifestyle and all that is required with RV financing. Our dedicated finance. Refinance your RV loan with Suncoast to save money with our low loan rates. Great. Hit the road with an RV loan from Greater Texas Credit Union. Enjoy competitive rates and flexible terms for your recreational vehicle purchase. Getting an RV loan isn't always easy with other loan companies. We have the best RV financing options available for credit-challenged customers because we. Looking to finance an RV? You can get pre-approved and financed with Camping World today. Camping World makes the process of financing for a camper easy. Michigan School & Government Credit Union offers RV Loans and RV Financing options with low rates. View our rates and apply online today. Mountain America offers RV financing, as well as financing for trailers, motorhomes and campers. We also provide a handy RV loan calculator to help you. Best RV Loans of · Best for Poor Credit: My Financing USA · Best Credit Union: NASA Federal Credit Union · Best for Large Used Loans: Southeast Financial. Are you in the market for a motorhome, fifth wheel, camper, or another recreational vehicle (RV)? You're in the right spot! Whether you're looking at new or. Refinance your RV loan with Suncoast to save money with our low loan rates. Great. NerdWallet's RV Loans in Compare RV Financing Options · LightStream: Best for Unsecured RV loans · Upgrade: Best for Unsecured RV loans · SoFi Personal Loan. Don't know where to start? Buying a new home can feel overwhelming, especially if you're a first-time buyer. Explore our loan options to find the best way to. Get a recreational vehicle loan with financing from USAA. We offer competitive rates & flexible terms on campers, travel trailers & motorhomes. GreatRVLoan is the premiere West Coast brokerage specializing in RV financing. We've been helping people achieve their RVing dreams by providing low loan rates. At My Financing USA, we can help you find the best RV loan rates & terms RV, your location, your credit score and your credit history. The rates we.

Cleaning Credit Report

A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. "Consumer Credit File Rights Under State and Federal Law "You have a right to dispute inaccurate information in your credit report by contacting the credit. Cleaning your credit reports in 6 steps · 1. Request your credit reports · 2. Review your credit reports · 3. Dispute all errors · 4. Lower your credit. Clean your credit report in less than 48 hours. Resources: HOW TO CLEAN YOUR CREDIT COURSE 40+ LESSONS 30+ TEMPLATES HOURS OF INSTRUCTION. The most reliable way to remove negative marks from your credit report is to wait until they're naturally removed. No negative marks will stay on your record. Though numerous companies claim they can clean up bad credit reports, Correcting erroneous information that may appear on credit reports takes time and effort. Yes, a credit repair service can legally claim to remove all negative items from your credit report, especially if they are legitimate debts. There are steps you can take to clean up your credit report. Here's how you can help put yourself back on a stellar credit track. My question to everyone is what should I do? Payoff the 2 debts in my collections then apply for car loans? Open a new Credit Card and show consistent payment. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. "Consumer Credit File Rights Under State and Federal Law "You have a right to dispute inaccurate information in your credit report by contacting the credit. Cleaning your credit reports in 6 steps · 1. Request your credit reports · 2. Review your credit reports · 3. Dispute all errors · 4. Lower your credit. Clean your credit report in less than 48 hours. Resources: HOW TO CLEAN YOUR CREDIT COURSE 40+ LESSONS 30+ TEMPLATES HOURS OF INSTRUCTION. The most reliable way to remove negative marks from your credit report is to wait until they're naturally removed. No negative marks will stay on your record. Though numerous companies claim they can clean up bad credit reports, Correcting erroneous information that may appear on credit reports takes time and effort. Yes, a credit repair service can legally claim to remove all negative items from your credit report, especially if they are legitimate debts. There are steps you can take to clean up your credit report. Here's how you can help put yourself back on a stellar credit track. My question to everyone is what should I do? Payoff the 2 debts in my collections then apply for car loans? Open a new Credit Card and show consistent payment.

Here's what to know about how to dispute errors on your credit report and avoid credit repair scams.

'Pay for delete' can sometimes remove negative information from your credit report, but it may not be worth it. Start by Checking Your Credit Reports to Identify the Issues · Prioritize Overdue and Outstanding Debts · Build a Recent Positive Payment History · Wait for Old. To keep track of your credit standing, you should review your credit report at least once each year. You can correct errors and clean up any wrong information. Successfully removing erroneous negative items from your client's credit report will increase the resulting credit score and help them qualify for mortgages. 5 Ways to Clean Up Your Credit · 1. Request copies of your credit reports · 2. Correct inaccuracies in your reports · 3. Know your FICO score · 4. Improve your FICO. If the dispute remains, you can file a written explanation that will be sent with your credit report whenever it is requested. You can also file a written. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information. The good news is, Wipe Credit Clean can remove your bad credit, regardless of whether the account is outstanding or paid. This is achieved by stating the. In this article, we will explore the steps you can take to remove hard inquiries from your credit report in the UAE. Clean Credit specialises in removing and improving your credit report, removing negative listings such as payment defaults or judgments. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close. Credit repair is the act of restoring or correcting a poor credit score. · Credit repair can also involve paying a company to contact the credit bureau and point. 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5. Increase your. You can download one, two or all three reports through a federally-mandated free website: ruvip.ru If you've never checked your credit report. I would talk to a bankruptcy attorney in your area. A lot of them do credit repair and they would be reputable, licensed, etc. They would. How to improve your credit score · lower your credit card limit · limit how many applications you make for credit · pay your rent or mortgage on time · pay your. FACT: No one can legally remove negative information from a credit report that is accurate. Most negative information generally stays on your report for seven. To repair your payment history, you'll need to dispute all fraudulent transactions on your credit score. The sooner you catch and report these issues, the. While it's not possible to wipe your credit history clean, that doesn't mean it lasts forever. Luckily, if your credit history isn't where you'd like, you can. Clearing your credit score · Pay off your accounts. · Pay bills on time. · Check for court orders. · Check for errors. · Don't apply for more than one loan at a time.

Sign Into Hr Block

Login Loop: How to escape? · Enter username (or email) · Enter correct password · Taken to screen that says, " Or login with a one-time security. Block Advisors provides small business tax filing, bookkeeping services, & payroll. We help with in-person & online year-round small business services. Go to ruvip.ru and use the person icon in the upper right-hand corner to sign in or create a new account. You can contact H&R Block's main corporate office by phone at + For more prospecting data, LeadIQ has access to up-to-date and accurate contact. General Information. Where can I find my Ameriprise login credentials for importing tax data to H&R Block? To sign in to H&R Block's tax software, enter your username (your email address) and your password, then click Sign In. If you are a current or former H&R Block associate, please use the Associate Login button below on the right to log in through Single Sign On (SSO). Guest Login. H&R Block Logo Opens in a new tab. User reports indicate no current problems Login. App. Tax Filing. Close. Live Outage and Reported Problems Map. Stay. Your account will lock after three failed attempts to log in. If this occurs, you should wait 20 minutes for your H&R Block account to unlock, then try to log. Login Loop: How to escape? · Enter username (or email) · Enter correct password · Taken to screen that says, " Or login with a one-time security. Block Advisors provides small business tax filing, bookkeeping services, & payroll. We help with in-person & online year-round small business services. Go to ruvip.ru and use the person icon in the upper right-hand corner to sign in or create a new account. You can contact H&R Block's main corporate office by phone at + For more prospecting data, LeadIQ has access to up-to-date and accurate contact. General Information. Where can I find my Ameriprise login credentials for importing tax data to H&R Block? To sign in to H&R Block's tax software, enter your username (your email address) and your password, then click Sign In. If you are a current or former H&R Block associate, please use the Associate Login button below on the right to log in through Single Sign On (SSO). Guest Login. H&R Block Logo Opens in a new tab. User reports indicate no current problems Login. App. Tax Filing. Close. Live Outage and Reported Problems Map. Stay. Your account will lock after three failed attempts to log in. If this occurs, you should wait 20 minutes for your H&R Block account to unlock, then try to log.

Get in touch with an H&R Block tax pro any time of the year, with secure messaging, screensharing, and video chat capabilities. Enjoy a stress-free solution. Welcome to your H&R Block Library. Log in. Forgot password? Privacy Policy. Join now Sign in. H&R Block in Worldwide. Expand search. Jobs. This JME Eden Enterprises DBA HR Block. Financial Services. Plover. If you're experiencing difficulties logging into your account, please contact our support team at [email protected] or via the Product Support Portal. Manage your tax prep from anywhere with the MyBlock app. Check your return status, store and share records securely, plus access the power of tax pros at your. Learn about the H&R Block Emerald Card that makes it easy to access your tax refund and more! Enjoy paying bills and managing all of your money in one card. Learn how to manage your account, troubleshoot when you're having trouble logging in, plus other tips and tricks. Browse online help Sign in to your account. Sign into H&R Block. Access H&R Block from NetBenefits® to get discount. Login to H&R Block with an existing account or create a new account. 2. Select tax. If you sign into your account on an unknown device or browser, you'll need a H&R Block security code to gain access. We explain how to find this security. If you've forgotten your username or password, or have been blocked from logging into your account, choose the Forgot My Username link next to the username box. Go to ruvip.ru and use the person icon in the upper right-hand corner to sign in or create a new account. You can also bookmark the link at ruvip.ru When I scrolled alllll the way down to the bottom of the home page and clicked “MyBlock” then signed in from there it took me to an alternate. Welcome to your H&R Block Library. Log in. Forgot password? Privacy Policy. Login to our. Online Tax Express account. Username. Password Show. Remember username. Passwordless Login. Login with password. I I'm new to H&R Block. Sign. Here, you'll find all the answers you need to access your H&R Block account, sign in to new or existing accounts, and reset your username and password, and more. Facebook wordmark. Log in. Cover photo of H&R Block. H&R Block. . K likes. . K followers. With upfront transparent pricing, % accuracy and a max. HR Block - Shop for downloadable softwares like Microsoft Office To join Dell Rewards, sign into your Dell Account (or create one) and select. Sign in to your H&R Block account. Email or username. Password. Remember Me. I forgot my username or password. I'm new to H&R Block. How to Create H&R Block Account? · Go to their official site at H and R Block Login webpage. · Choose My Account login in the upper right-hand corner of the.

Price Of Iridium Per Ounce

Iridium. $4, USD/ozt. 52 weeks USD/ozt. Low | High Last Close: Aug 29, USD, CAD, EUR, RUB, GBP, AUD, MRL, MXN, PEN, ZAR. Troy Ounce. Rhodium ; Gold · $ 2, ; Silver · $ ; Platinum · $ ; Palladium · $ ; Iridium · $ 4, 0. At today's price of $ per gram, iridium has changed –% so far this year. Since Jan 1st ($ per gram), it has gained +%, and compared. Updated: , price per ounce (1 oz = g), Price difference based on the previous day. Iridium price Chart - Iridium spot price per troy ounce. Chose. Heraeus Precious Metal Prices: current prices in Euro and per gram, bid and offer, offer price for fabricated and unfabricated metals. In the second half quarter of , the price of iridium in the United States reached USD/Troy Ounce. Total Deliverables Per Year: 12 (One Per Month). Platinum · ; Palladium · ; Rhodium · 4, ; Iridium · 4, ; Ruthenium · With this situation it is not surprising to find that the price of the metal to be high. While it was never cheap, the spot price quadrupled when Covid hit and. That's why currently the price of iridium is about $ per ounce. Iridium as Investment. Very rarely do people invest in iridium, as it is considered a minor. Iridium. $4, USD/ozt. 52 weeks USD/ozt. Low | High Last Close: Aug 29, USD, CAD, EUR, RUB, GBP, AUD, MRL, MXN, PEN, ZAR. Troy Ounce. Rhodium ; Gold · $ 2, ; Silver · $ ; Platinum · $ ; Palladium · $ ; Iridium · $ 4, 0. At today's price of $ per gram, iridium has changed –% so far this year. Since Jan 1st ($ per gram), it has gained +%, and compared. Updated: , price per ounce (1 oz = g), Price difference based on the previous day. Iridium price Chart - Iridium spot price per troy ounce. Chose. Heraeus Precious Metal Prices: current prices in Euro and per gram, bid and offer, offer price for fabricated and unfabricated metals. In the second half quarter of , the price of iridium in the United States reached USD/Troy Ounce. Total Deliverables Per Year: 12 (One Per Month). Platinum · ; Palladium · ; Rhodium · 4, ; Iridium · 4, ; Ruthenium · With this situation it is not surprising to find that the price of the metal to be high. While it was never cheap, the spot price quadrupled when Covid hit and. That's why currently the price of iridium is about $ per ounce. Iridium as Investment. Very rarely do people invest in iridium, as it is considered a minor.

Iridium price history ; Iridium price (USD/oz), , , ; Iridium price (GBP/oz), , , Updated: , price per ounce (1 oz = g), Price difference based on the previous day. Iridium price Chart - Iridium spot price per troy ounce. Chose. Currently the price of iridium is about $ per ounce and gold is $ Up-to-date prices of precious metals are at ruvip.ru | Live. Get updated data about gold, silver and other metals prices. Find gold, silver, and copper futures and spot prices. Iridium Prices for the Last Month ; $, Aug 14, ; $, Aug 13, ; $, Aug 12, ; $, Aug 08, Gold Price per Ounce (USD), , , , , , , 3, Silver Price per Ounce (USD), , , , , , , GBP / Oz, USD / Oz, Euro / Oz, Gold price History. Metal: Gold, Gold, Silver, Platinum, Palladium, Iridium, Rhodium, Ruthenium. GO. 25/02/21 The price for Rhodium at today's rate is $24, per oz (Nearly $ per gram) and Iridium is $4, per oz. In This Full Precious Metal Set you. Currently the price of iridium is about $ per ounce and gold is $ Up-to-date prices of precious metals are at ruvip.ru | Live. Copper prices per tonnes. Precious Metals. Metal Price. Month Year. Copper Platinum Price (USD / Troy Ounce) · Courtesy ruvip.ru Loading. Iridium is in many ways the ultimate precious metal. Extremely dense, super rare, rustproof and very, very costly. Daily Metal Prices (EIB) USD per Troy Ounce ; Iridium, Ir, troy ounce, $ ; Ruthenium, Ru, troy ounce, $ –98, New York price per troy ounce of percent-pure palladium in ounce lots, in Platt's Metals Week. , –, Englehard unfabricated price of. Which variables impact the price of iridium? Where Thus, investors will expect a profitable iridium price ranging from $4,$5, per ounce in Price per ozt, Date of discovery. Californium, $,,, Rhodium, $13,, Iridium 1 Ounce Palladium Bars. In Stock. from. Iridium prices have fluctuated between US$ and US$ per troy ounce over the past decade. Prior to , the price for iridium was fairly stable at. The LBMA Gold and Silver Price benchmarks are the global benchmark prices for unallocated gold and silver delivered in London. Metal. Price (per kg as of Jan 8, ). Price (per ounce as of Jan 8, ) ; Platinum. 30, ; Rhodium. 22, ; Gold. 38, 1, ; Iridium. 18, Rhodium ; Gold · $ 2, ; Silver · $ ; Platinum · $ ; Palladium · $ ; Iridium · $ 4, 0. The entered price of “Iridium” per 9 ounces is equal to Please enable ounce per cubic inch [oz/inch³]. Melting Point (MP), Iridium changes.

How Can I Afford A Car

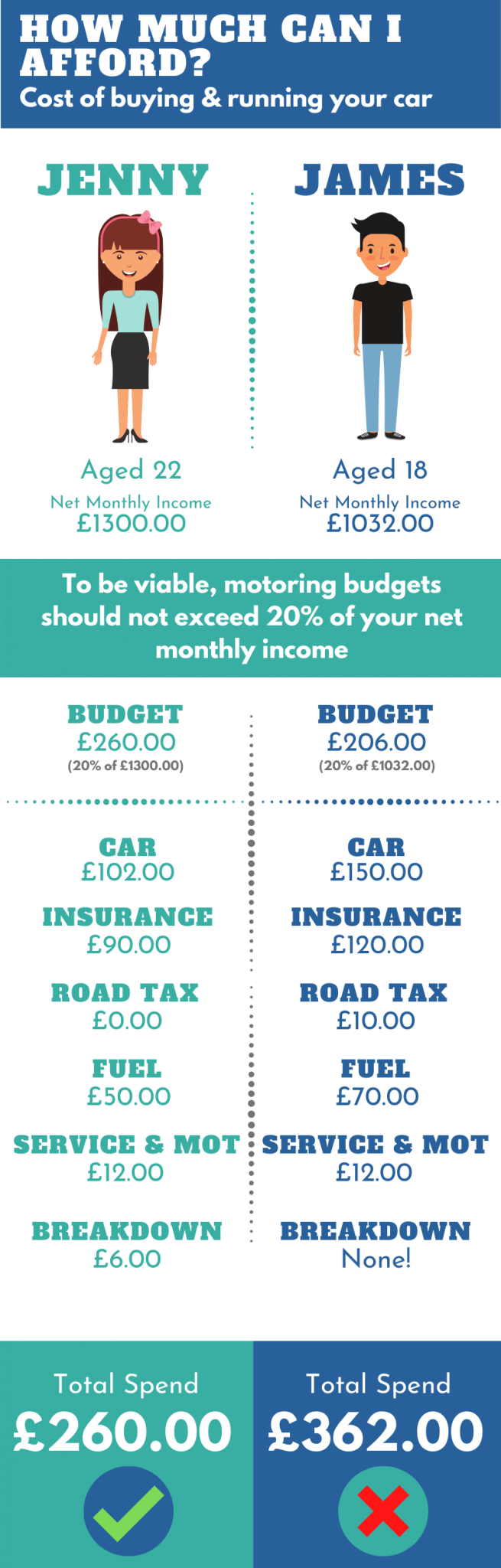

Use The 20/4/10 Rule To Determine Affordability · Put up 20% of the purchase price for a down payment. · Pay off the auto loan in 4 years or less. · Your. Courses & Tools. How about more sense and more money? The 20/3/8 car-buying rule helps ensure you keep your finances on-track while financing a vehicle. Enter. If you need to buy a vehicle right now, we'll provide expert tips on how you can navigate higher interest rates to help save you money. When it comes to buying a used car on finance, you want to be sure you can afford the payments. You need to know how much you can afford to pay back each. There's no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home. What Car Can I Afford · 1. Multiply your gross monthly income by · 2. Add all of your current monthly payments, including mortgage or rent, credit card. Evaluate whether you can afford a vehicle by estimating your monthly payment and comparing it to your budget with ruvip.ru's car affordability calculator. For example, if your car payment will be $ per month, take that amount, and put it into savings instead. If you can make timely payments on your other bills. Monthly payments should be less than % of your take-home pay (after taxes). All costs of car ownership should be 10% of your pre-tax monthly income, or. Use The 20/4/10 Rule To Determine Affordability · Put up 20% of the purchase price for a down payment. · Pay off the auto loan in 4 years or less. · Your. Courses & Tools. How about more sense and more money? The 20/3/8 car-buying rule helps ensure you keep your finances on-track while financing a vehicle. Enter. If you need to buy a vehicle right now, we'll provide expert tips on how you can navigate higher interest rates to help save you money. When it comes to buying a used car on finance, you want to be sure you can afford the payments. You need to know how much you can afford to pay back each. There's no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home. What Car Can I Afford · 1. Multiply your gross monthly income by · 2. Add all of your current monthly payments, including mortgage or rent, credit card. Evaluate whether you can afford a vehicle by estimating your monthly payment and comparing it to your budget with ruvip.ru's car affordability calculator. For example, if your car payment will be $ per month, take that amount, and put it into savings instead. If you can make timely payments on your other bills. Monthly payments should be less than % of your take-home pay (after taxes). All costs of car ownership should be 10% of your pre-tax monthly income, or.

First things first, how much car can you actually afford? One rule of thumb, popularised by financial guru Dave Ramsey, suggests that all your vehicles'. As a general rule of thumb, many experts suggest following the 20/4/10 rule, which holds that you should set aside 20% of a car's purchase price for a. This is a car affordability calculator using which you can find out a car that you can afford based on your Salary or Income. Step 1: Plan for the purchase in advance · Step 2: Challenge whether or not you can afford the car you want to buy right now · Step 3: Hold off buying a car until. This calculator starts with the payment that fits best into your budget and shows you how much you should spend on a car. Buy vehicles 10+ years old that are known for reliability. Try to find a great deal and pay in cash. Most ive ever paid for a personal vehicle. If you've been saving responsibly and have a healthy emergency fund in place already, then putting down the suggested 20% on that dream car might make sense. If. Purchasing a dream car can be done if you take some time to plan. In this article, we provide you seven steps that will enable you to finally own the car of. Use our car affordability calculator by inputting your information to view the total cost of a vehicle you can afford. The tool also functions as an auto loan. How Much Car Can I Afford Based on Salary? · Consider the Overall Cost of Ownership · Hidden Costs · Research Before You Buy · Financing Factors & Considerations. It is a smart move to spend 10% or less of your earnings on a car purchase. This helps keep your total car expenses between 15% to 20% of your monthly earnings. If you get a month loan with an interest rate of % and put down 20% of the vehicle price, the most you could afford is $16, With 20% down, you. Vehicle Affordability Calculator Example This information may help you analyze your financial needs. It is based on information and assumptions provided by. Experts say your total car expenses, including monthly payments, insurance, gas and maintenance, should be about 20 percent of your take-home monthly pay. The calculator will give your estimated weekly, biweekly, or monthly payments and the cost of borrowing. Finance calculator. What can I afford? Courses & Tools. How about more sense and more money? The 20/3/8 car-buying rule helps ensure you keep your finances on-track while financing a vehicle. Enter. This includes how much money you can afford for a down payment, the loan rate, car insurance, dealership fees, taxes, gas, and recurring maintenance needs. The car that you can afford will depend on your salary, disposable income, financial circumstances, and car running costs. Monthly Payment: When deciding how much car you can afford, you'll want to consider your take-home pay—which is the amount you make each month after taxes and. How much car can you afford and how long should your loan be? · Your total household transportation budget should be less than 15% of your take-home pay. · You.